Want to know more about the most flexible budget rule, then here’s how to budget your money the 50-20-30 rule?

Let’s dive into the easiest way to understand the 50-20-30 budget rule.

[lwptoc]

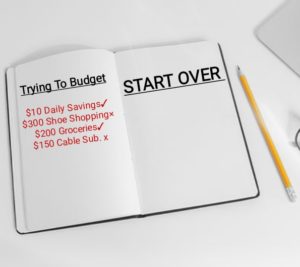

Budgeting money is one of the easiest ways to manage your personal finance and spend money wisely.

Making the decision to start budgeting money is a wise one, but you shouldn’t rejoice yet because budgeting can be tricky, you need to find out the most effective method that will serve your purpose better.

Since people find budgeting a complicated venture because they do not like to be told how to spend their money or risk comfort when they have the money to spend, it becomes necessary to find a flexible budget method that will not keep you restless and on your toes.

Fact is, if a budget does not allow for any fun, it becomes a super burden!

One way to start a budget and take the burden out of budgeting is to use the 50-20-30 rule which is one of the favorites among financial experts and budgeting beginners.

To me, this is the most realistic way to actually budget intentionally as a beginner to budgeting.

It is the best way to create a budget without giving up all the things you love.

Although I am a frugal person, I certainly don’t like to go bare bones with my budget. I like the idea of keeping my coffee budget, and my expensive self-care treats that certainly keeps me sane.

So how to budget your money the 50-20-30 rule?

The 50-20-30 budget is a method popularized by Senator Elizabeth Warren, that works by breaking your spending into three key categories.

Living expenses- 50%: This category is crafted to house all your fixed expenses, which includes essentials such as transportation, utilities, rent, food.

Savings and investment-20%: This portion of your budget includes money you are saving to meet up financial goals like your emergency fund, retirement fund, education funds or other investment ventures and debt pay off.

Adjustable, discretionary or variable expenses-30%: This remaining part of the budget is to cater for your non-necessities or pressing needs such as phone bills, gym membership, travel costs, Spa, entertainment and restaurants.

The sense in this budgeting method is that you get to live a good life while sticking to a budget. With a 30% allocation to your non-essential Necessities, you have a chance of enjoying a flexible and comfortable life while maintaining a budget.

How do I start budgeting with the 50-20-30 rule?

How To Budget Your Money The 50-20-30 Rule Like a Pro!

The first step to budgeting is to get a hold of all your financial information from whatever source- including raises and free cash. If you are self-employed then your monthly income is any cash remaining after-tax deduction and business funding.

The next step will be finding exactly where you spend your money every month. If you can’t get a grip of things you spend money on every month, go get your bank statements and start extracting accordingly to fill into your new budget.

The next question is;

How do I adjust my spending to meet the 50-20-30 rule?

The 50-20-30 budget role is not a do-or-die affair, as a beginner, you are bound to make mistakes that will self-correct as you practice over time.

The key to this budgeting method is to review your budget as often as you can, adjust as possible, identify loopholes and amend as necessary.

If your housing is taking up so much of your funds, then it is time to look for a new compatible apartment.

If gas is taking up so much of your funds, then it is time to start driving less and using more public transportation. If meals are digging up your budget, then it is time you start eating home-cooked meals using a meal plan.

You may also want to know-

What are the benefits of budgeting with the 50-20-30 rule?

Like with any other effective budgeting method, the aim is to help you get your finances in order and manage your income wisely.

The 50-20-30 rule will help you quickly break down your expenses, categorize them accordingly and simplify the whole budgeting process.

The 50-20-30 projects rule can help you;

- Simplify budgeting process

- Categorize your expenses more comfortably

- Identify spending loopholes

- Build your money

- Quickly pay off debt

- Enable financial freedom to retire early

- Help you purchase big off expenses

- Save more money

- Stay dept free

- Learn skillful management and accountability

In all, the 50-20-30 budget rule is a fantastic way to save more money, live a generous life and meet up your financial goals quickly without giving up all the things that you love.

Finally, know How To Budget Your Money with The 50-20-30 Rule Like a Pro!

Start!!!

But you need to learn ways to save more money in other to be great at budgeting!

See helpful tips to help you save thousands today.

- 9 Reasons Why Budgeting Is Important No Matter Your Income.

- 8 Challenges of Budgeting and Best Tips to Overcome Them

- How to Save Money From Your Salary Each Month

- How to Save Money On Energy Bills

- 13 Ways to Save Money as a Stay at Home Mom For 2021

- 14 Tips On How to Save Money On Groceries

- 50 Minimalist Lifestyle Tips That Will Save You Money In 2021

- 21 Tips to Start a Low Waste Life and Save More Money For 2021

- How to Save Money Each Month With These 10 Easy Tips

- How to Save Money On Food This Year

- How to not spend money and save In 7 Steps

- 7 Personal Finance Hacks $ Tips Guaranteed to Make You Wealthy

- 50 Money-Saving Challenge to Start According to Your Earnings

- I Stop Spending Money On These 10 Things (saved me $3000 in 6 months)

- How to Save Money On Gas or Fuel

If you find this post helpful, do share it with a loved one!

Sharing is caring!